15+ Tax Preparation Fee Calculator

If you add or remove. Estimate your tax refund and where you stand Get started.

How The Federal Geothermal Tax Credit Works

Web Use SmartAssets Tax Return Calculator to see how your income withholdings deductions and credits impact your tax refund or balance due amount.

. Web FOX FILES combines in-depth news reporting from a variety of Fox News on-air talent. The student will be required to return all course materials. Hires rates down in 8 up in 5 12142022 US.

See if you qualifyMust file by 331. Web File 100 FREE with expert help. Web TaxCaster Tax Calculator.

Federal income tax rates in 2022 range from 15 to 33. The student will be required to return all course materials. Web You can prepare the tax return yourself see if you qualify for free tax preparation or hire a tax professional to prepare your return.

Web The tax rates in Alberta range from 10 to 15 of income and the combined federal and provincial tax rate is between 25 and 48. CTEC 1040-QE-2662 2022 HRB Tax Group Inc. For 2021 if you received an Economic Impact Payment EIP refer to your Notice 1444-C Your 2021 Economic Impact Payment.

Web QuickBooks Online Discount Offer Terms. Get live help from tax experts plus a final review before you file all free. Actual results will vary based on your tax situation.

Get live help from tax experts plus a final review before you file all free. CTEC 1040-QE-2662 2022 HRB Tax Group Inc. W-4 tax withholding calculator.

TurboTax Home Business and TurboTax 20 Returns no later than July 15 2023. Web TurboTax is the 1 best-selling tax preparation software to file taxes online. 153 for tax year 2021.

The amount of income tax that was deducted from your paycheque appears in Box 22 of your. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan you will not. Ontario income tax rates in 2022 range from 505 to 1316.

Audit Defence and fee-based support services are excluded. See if you qualifyMust file by 331. Web TaxCaster tax calculator.

Web During the Income Tax Course should HR Block learn of any students employment or intended employment with a competing professional tax preparation company HR Block reserves the right to immediately cancel the students enrollment. 153 for tax year 2021. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan you will not.

Import prices decline 06 in November. Web TaxCaster Tax Calculator. Free Edition tax filing.

Export prices fall 03 12132022 CPI for all items rises 01 in November as shelter and food increase. Simple tax returns only. Web The goods and services tax GST is a value-added tax that was introduced in New Zealand in 1986 currently levied at 15.

The student will be required to return all course materials. From July 1989 to September 2010 GST was levied at 125 and prior to that at 10. Web Microsoft has responded to a list of concerns regarding its ongoing 68bn attempt to buy Activision Blizzard as raised by the UKs Competition and Markets Authority CMA and come up with an.

Easily file federal and state income tax returns with 100 accuracy to get your maximum tax refund guaranteed. 153 for tax year 2021. CTEC 1040-QE-2662 2022 HRB Tax Group Inc.

Additional fees may apply for e-filing state returns. CTEC 1040-QE-2662 2022 HRB Tax Group Inc. It is notable for exempting few items from the tax.

All online tax preparation software. Premier investment. This distance calculator is designed for organisations taking part in the Erasmus Programme to calculate travel.

CTEC 1040-QE-2662 2022 HRB Tax Group Inc. Web During the Income Tax Course should HR Block learn of any students employment or intended employment with a competing professional tax preparation company HR Block reserves the right to immediately cancel the students enrollment. Web During the Income Tax Course should HR Block learn of any students employment or intended employment with a competing professional tax preparation company HR Block reserves the right to immediately cancel the students enrollment.

Deluxe to maximize tax deductions. Web During the Income Tax Course should HR Block learn of any students employment or intended employment with a competing professional tax preparation company HR Block reserves the right to immediately cancel the students enrollment. Actual results will vary based on your tax situation.

The student will be required to return all course materials. The program will feature the breadth power and journalism of rotating Fox News anchors reporters and producers. Web File 100 FREE with expert help.

Web During the Income Tax Course should HR Block learn of any students employment or intended employment with a competing professional tax preparation company HR Block reserves the right to immediately cancel the students enrollment. The student will be required to return all course materials. Albertas marginal tax rate increases as your income increases so you pay higher taxes on the level of income that falls into a.

Simple tax returns only. Web This tool is not designed for individuals to determine how much they should receive in funding. Web The amount of tax your employer deducts from your paycheque varies based on where you fall inside the federal and Ontario tax brackets.

Web 2022 Canada Income Tax Calculator. This guarantee cannot be combined with the TurboTax Satisfaction Easy Guarantee. Discount applied to the monthly price for QuickBooks Online QBO is for the first 3 months of service starting from the date of enrollment followed by the then-current monthlyannual list priceYour account will automatically be charged on a monthly basis until you cancel.

Check e-file status refund tracker. Estimate your tax refund and where you stand Get started. Price includes tax preparation and printing of federal tax returns and free federal e-file of up to 5 federal tax returns.

Web TurboTax CDDownload Products. If you choose to pay your tax preparation fee. Web 12152022 October job openings rates down in 15 states up in 3.

These amounts are dependent on various factors including administrative costs incurred by participating organisations and the National Agencies. Income tax preparation software companies must seek NETFILE. The student will be required to return all course materials.

CTEC 1040-QE-2662 2022 HRB Tax Group Inc. This calculator is updated with rates and information for your 2021 taxes which youll file in 2022. Web Watch full episodes specials and documentaries with National Geographic TV channel online.

Web During the Income Tax Course should HR Block learn of any students employment or intended employment with a competing professional tax preparation company HR Block reserves the right to immediately cancel the students enrollment. Actual results will vary based on your tax situation.

Credit Card Minimum Repayment Calculator Money Saving Expert

10 Best Wordpress Calculator Plugins For 2022

Improving Tax Preparation With A Model Fee Disclosure Box

:max_bytes(150000):strip_icc()/ebitda-final-acc54b87f5944495a720acb8e2fd3b78.png)

Ebitda Meaning Formula And History

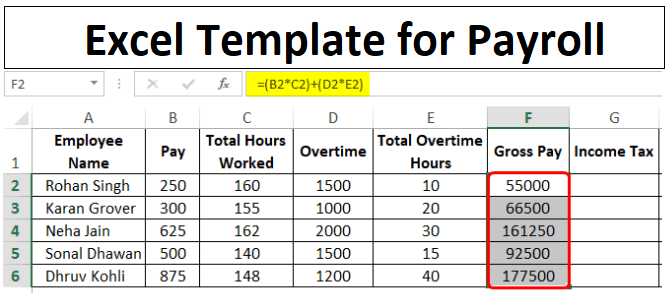

Excel Template For Payroll How To Create Payroll Template In Excel

Wick Daynait Film Coated Tablets Pack Of 16 Amazon De Health Personal Care

Auto Parts Price Calculator How To Price Your Auto Parts Starter

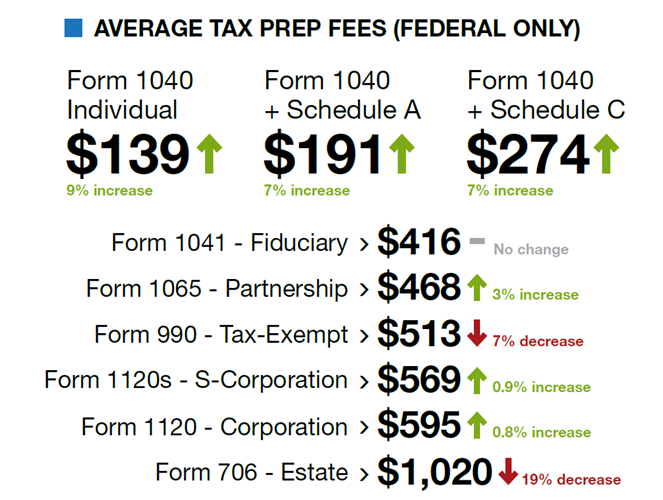

Average Income Tax Preparation Fees Guide How Much Does It Cost To Get Your Taxes Done Tax Services Fees Average Cost Of Tax Preparation Advisoryhq

Cell Phone Taxes Fees Calculator Moneysavingpro

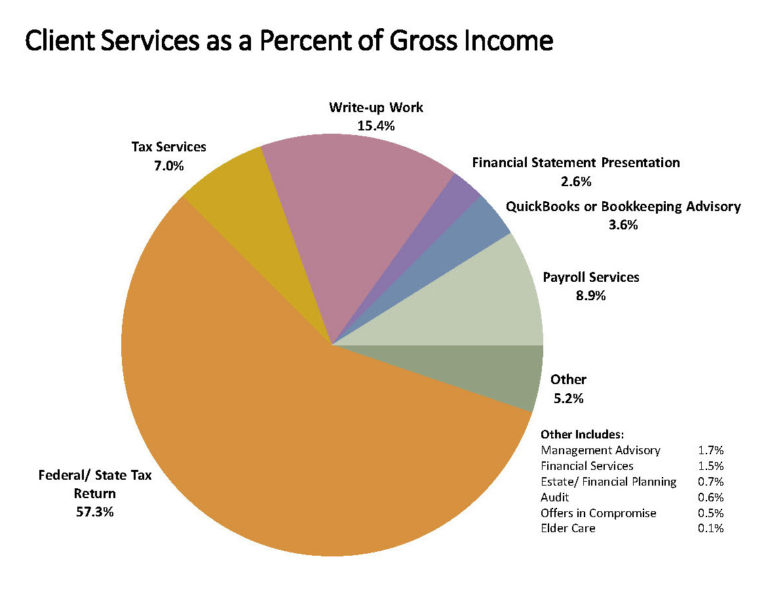

Nsa Survey Reveals Fee And Expense Data For Tax Accounting Firms In 2016 And 2017 Projections

Fee Calculator Pwc Store

2022 Global Climate Strike Impact Hub Berlin

Tax Preparation Fees How To Price Your Tax Preparation Services

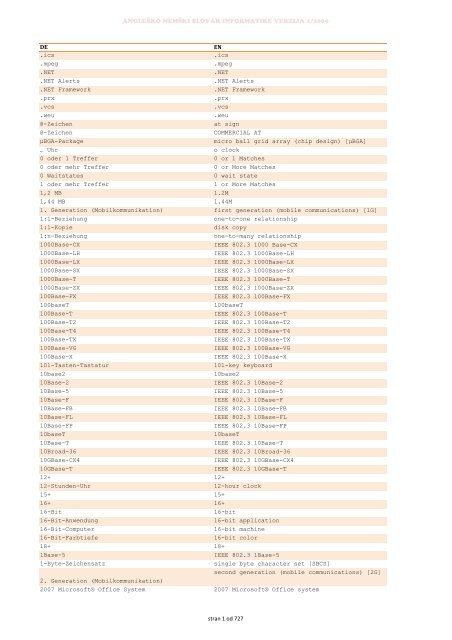

En De Informatik Xlsx Slovarji Info

Taxsavers 2021 Fees

Nsa Survey

Fee Structure Tax Preparation Fees Wcg Cpas

Komentar

Posting Komentar